BULLS ON PARADE

“The excessive increase of anything

causes a reaction in the opposite direction.”

Plato

Like much of America I’ve been watching Landman, a show about oil exploration in West Texas. There’s a scene where Tommy Norris (played by Billy Bob Thornton) receives a dressing down from his new boss for being too cautious. Oil workers are used to colorful language, but if you want to pick a fight with a wildcatter, calling him chicken is a good place to start.

His boss (Demi Moore) is an inexperienced CEO, betting her heavily indebted company on a single well with slim odds of success. If it hits, she stands to make billions. If it doesn’t, bankruptcy is inevitable. When Tommy refuses to play along, she explains that risk is the lifeblood of the oil business and “the President of my company can’t be averse to the very thing that built it.”

I’ve yet to set boot in the Permian, but when I think of last year’s equity market, I feel Tommy’s pain. A few stats:

The S&P 500 delivered its third consecutive year of double-digit returns. The only streaks longer were the dot-com bubble and the post WWII industrial boom (the best market ever). Valuations are higher than at any time other than the late 1990s.

According to JP Morgan, retail investors purchased $325 billion of equities in 2025, 50% more than 2024 and nearly twice the five-year average. Known for momentum chasing, retail appetite and market peaks often coincide.

Since Liberation Day, the Russell 2000 has risen 50%, a blistering 65% annualized, largely on the backs of unprofitable stocks. A Goldman Sachs measure of risk appetite is the highest in four years and in the 98th percentile since it began in 1991.

In January, small caps outperformed the S&P 500 for 14 consecutive sessions, its longest streak since 1996. In the first 16 trading days of 2026, the index hit nine all-time highs.

In short, the bulls are on parade and caution has gone from a virtue to an insult. The recession that was ‘supposed to’ occur in 2022 failed to materialize, risk taking has consistently been rewarded and the more discriminating among us seem woefully out of synch with the times.

I’m reminded of what ex-Citi CEO Charlie Price said after the Financial Crisis.

“As long as the music is playing, you’ve got to get up and dance.”

Seeing that Citi lost 96% of its value under his watch, it’s probably okay to sit out a song or two. As the fund is relatively new, I hope the jury is still out on my dancing ability, but while we’re here, we might as well discuss incentives. One of the flaws of any fund with an incentive fee is that it’s heads I win, tails you lose. The fund’s predecessor returned 49% in 2020, and under a similar fee structure, my upside would have been multiples of the management fee. If a manager posts a down year, their reputation suffers but his partners bear the loss. This asymmetry is especially acute early in a fund’s life where stellar performance is sure to attract assets, and because most funds start small, there’s less at stake. If you want to encourage excessive risk taking, give a manager a little capital, unlimited upside and few constraints.

I’m trying to earn a reputation for being disciplined and you can’t measure risk-tolerance in a bull market. The fund averaged 44% cash in 2025, which could lead some to think I’m a perma-bear, worrywart, or a lineal descendant of Chicken Little. Allow me to elaborate.

First, cash ended the year at 20% and remained below 50% after April. While it’s true the index returned 12.8% last year, two-thirds of it came on April 9th, as the Russell 2000 rose 8.6% when reciprocal tariffs were paused for 90% days. More than 100% of the fund’s underperformance in 2025 can be attributed to a single day.

Last month, I mentioned the median small cap (regardless of index) underperformed cash in 2025. My decision to scale deliberately was an attempt to reduce inception risk since funds that have a poor first year rarely have a second. Almost one-third of all hedge funds closed in 2008 and the industry isn’t exactly known for its durability.

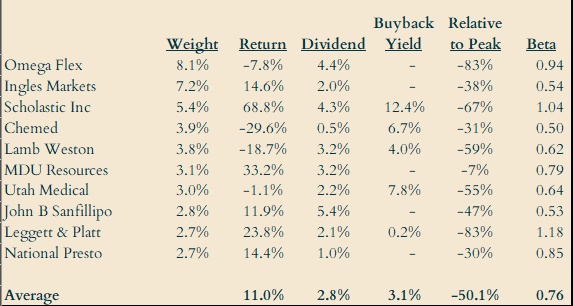

Here are the fund’s top ten positions, weights and returns as of 12/31/25. Returns are dollar-weighted, “Buyback Yield” represents stock repurchases divided by market capitalization and “Relative to Peak” is the portfolio’s cost basis compared to the security’s all-time high. “Beta” is a measure of price volatility relative to the Russell 2000 Index.

.

Rather than discuss the merits of each, permit me a few generalities.

INDEX AGNOSTIC: Because prospective buyers compare performance over relatively short periods, funds are becoming more index-like reducing the odds of differentiated returns. I report performance relative to the Russell 2000 but deliberately try not to resemble it.

ANTI- MOMENTUM: When markets get inflows, rates are falling and liquidity improving, momentum stocks tend to dominate. Conversely, when sentiment sours, they typically underperform. The fund’s average holding was purchased 50% below its all-time high demonstrating a strong bias against momentum.

UNPOPULAR: Most of last year’s performance was concentrated in just a few industries: AI capex beneficiaries, nuclear, defense and space companies, rare earth metals and other emerging technologies. Thematic investing can work temporarily, but the market is littered with the casualties of once-hot trends.

CONCENTRATION: The index contains almost 2000 stocks, making their average weight just five basis-points (or 1/20th of 1%). Many small cap funds hide behind diversification, owning hundreds of securities so they can absorb capital and minimize performance risk. The fund has an 8% position which demonstrates tremendous conviction. Said another way, the manager with 300 securities can afford to speculate. The manager with 34 cannot.

PROFITABILITY: Each of the top ten are profitable. As previously mentioned, nonprofitable small caps were up 42% in 2025, more than three-times the index’s return.

LOW VOLATILITY: Many are in defensive industries (there are three staples, two health care companies and a utility). These are rarely the standard fare of a fence swinger. Low volatility stocks were up 6.6% last year, while high volatility stocks were up 30%.

SHAREHOLDER RETURNS: All ten pay a dividend and many are repurchasing their shares. Most dividend paying stocks were down last year and companies that bought their own stock were the worst performers in 2025. If someone could explain this to me, I’d be grateful.

Please don’t mistake me, I’m far from disappointed in the fund’s first year. I’ve given considerable attention to how to scale the fund in a way that generates respectable returns and preserves your capital. Too many funds prioritize the first while ignoring the second. I believe strongly (but can’t guarantee) that this strategy is likely to deliver superior returns in both absolute and risk adjusted terms over a market cycle. But it may take a few years to prove it.

Sincerely,

Dan Walker